Ramifications of the Change in Hong Kong’s Trade Status for Importers and Exporters in the U.S. Market

Hong Kong’s change in trade status had a significant impact on the U.S. regulatory enforcement of transactions with Hong Kong entities, especially country of origin marking, assessment of Antidumping & Countervailing Duties, and controlled exports.

Forced Labor in Xinjiang: What you need to know

Human rights violations run rampant within China’s Uyghur Autonomous Region (Xinjiang), targeting ethnic and religious minority groups such as Uyghurs, ethnic Kazakhs, and ethnic Kyrgyz. The PRC government in Xinjiang has unjustly imprisoned more than one million individuals from these minority groups since 2017.

USMCA Proposed Rule Change – Expanding Part 102 Marking Rules

By Jennifer Horvath, Partner, Braumiller Law Group

U.S. Customs and Border Protection (“CBP” or “Customs”) recently released a proposed rule (FR 86 35422) which would expand the usage of the U.S. – Canada – Mexico Agreement marking rules found in 19 C.F.R. Part 102 (herein after “Part 102”).

Non-Preferential Origin Rules – Which Do You Prefer?

By: By Adrienne Braumiller, Partner & Founder, Braumiller Law Group

There are two basic sets of country of origin rules that may apply to imports: (1) The preferential origin rules for articles considered “originating” under a free trade agreement; and (2) the non-preferential rules for articles not qualifying under a free trade agreement.

The U.S. Strike Force on Unfair Trade A Global Perspective, But It’s Really Just About China

By: By Bob Brewer, Braumiller Law Group

In the ongoing tit-for-tat trade war with China and the U.S., new developments are actually old policies, but seem to be resurfacing as the escalation in loss of patience continues to bring about more protectionism. It’s a global implementation, but the United States will target China with a new “strike force” to combat unfair trade practices.

Developing Digital Approaches to Trade Finance

By: James R. Holbein, Counsel to Braumiller Law Group PLLC

The digital revolution affecting so much change across the world is coming to international trade processing and logistics. The transition to all digital documentation and processing from formerly inefficient analog systems is well underway.

UK POST BREXIT TRADE STRATEGY: MEXICO

By Joaquin-Pampin-Galan and Brenda Cordova

Five years ago, the United Kingdom (“UK”) decided in a referendum to leave the European Union (“EU”). Negotiations began for the UK to leave the bloc in an environment surrendered by uncertainty for some and optimism for others.

The ITAR Australia and UK Exemptions – Better Read the Regulations Carefully

By: Bruce Leeds, Senior Counsel to Braumiller Law Group and George Alfonso, Of Counsel to Braumiller Law Group and President of Reigncore Lobbying

On behalf of our example, we’d like to introduce you to “Joe Compliance.” Imagine Joe Compliance is going through the International Traffic in Arms Regulations (ITAR) and notices license exemptions for Australia and the UK in Part 126.16 126.17.

Latest Update on Section 301 Litigation

By: Adrienne Braumiller, Founding Partner, Braumiller Law Group On June 1, 2021, the U.S. Government, in the ongoing Court of International Trade (“CIT”) litigation over List 3 and List 4A Section 301 tariffs on certain imports of Chinese products, filed a Motion to Dismiss for the “failure to state a claim” and, alternatively a Motion to […]

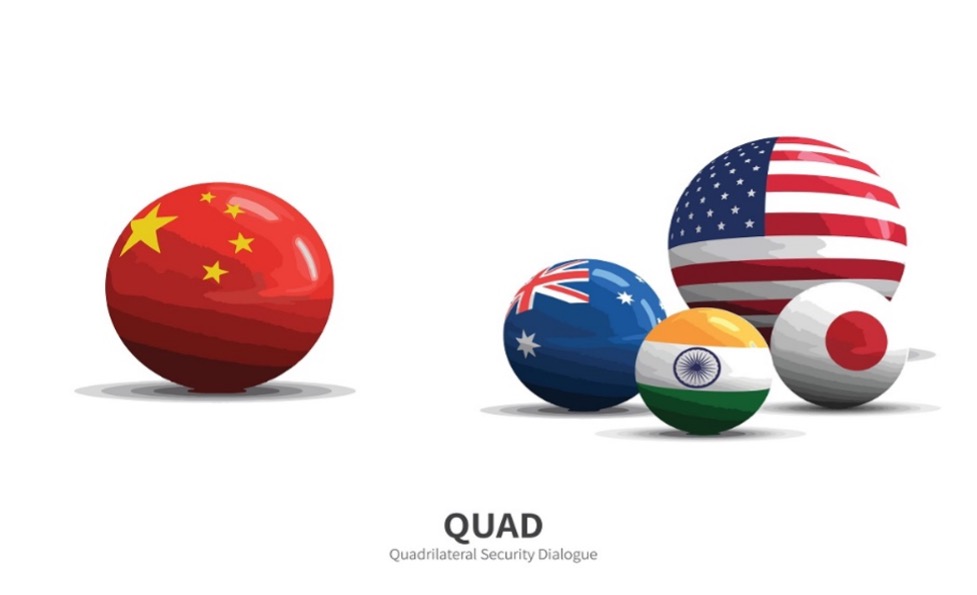

The Quad and International Trade? The U.S., Australia, Japan and India

By: Bob Brewer, Braumiller Law Group When the “Big Bully” is also your best friend, economically speaking, and metaphorically speaking, they are paying for your lunch, but at the same time are slapping you around on the playground…do you hit back, or just take it on the chin? You need your lunch, as you have to […]