USMCA: Negotiation Preparations

The United States-Mexico-Canada Agreement (USMCA) is a trilateral free trade agreement that went into effect on July 1, 2020, as a replacement for its predecessor, the North American Free Trade Agreement (NAFTA). The three involved governments are preparing to initiate the first formal joint review in July 2026 as part of the sixth anniversary of the agreement entering into effect.

IEEPA Litigation – Should you be Involved?

Hundreds of importers have rushed to file lawsuits challenging tariffs imposed under the International Emergency Economic Powers Act (IEEPA) as they await a Supreme Court ruling on the statute’s overall legality.

Uncertainty Surrounding the Use of Artificial Intelligence (AI) in Tax and Customs / Foreign Trade Compliance

AI is now deeply embedded in the internet and social media, producing everything from humorous content and realistic simulations to advanced automation. These capabilities have expanded beyond entertainment and productivity, reaching into areas of public administration and government oversight. This raises a critical question: if AI is transforming nearly every sector, how will it reshape tax and customs compliance, and how will it be regulated?

Contracts Executed Between Mexican Companies and Foreigners – The New Mexican Customs Requirements

Mexico’s customs and foreign trade legal framework has evolved into a substance-based compliance model. Authorities now expect importers to demonstrate not only what was imported, but also why, under what legal relationship, and under what economic terms the transaction took place.

Advisory Opinions From DDTC – What Are They?

The Directorate of Defense Trade Controls (DDTC) that administers and enforces the ITAR also issues Advisory Opinions (AO). What the heck is an AO? If you come from a Customs compliance background you know about Customs rulings and may have applied for some. An AO is sort of like a Customs ruling in that it is a written interpretation of the regulations.

Mexico’s Electronic Value Manifest (Manifestación de Valor Electrónica or MVE)

The MVE, which will be enforceable as of April 1, 2026, is a digital document integrated into Mexico’s Single Window for Foreign Trade (VUCEM – Ventanilla Única de Comercio Exterior) through which importers must declare the customs value of goods entering Mexico.

Renewal of Haiti HOPE/HELP and AGOA Trade Preferences Up to Senate

In its usual fashion, Congress has allowed the tariff preferences for Haiti under the United States-Caribbean Basin Trade Partnership Act (CBTPA) and the African Growth and Opportunity Act (AGOA) to expire on September 30, 2025. Two bills passed the House with bipartisan majorities on January 12, 2026, to renew the tariff preferences retroactively to the date of expiration and then extend them to September 30, 2028. Both bills are now in the Senate Finance Committee awaiting action. This article examines the current status and likely outcomes of Senate review.

Self-Declaring Under the Section 232 Automotive and MHDVP Programs

The October 17, 2025 Presidential Proclamation 10984 Adjusting Imports of Medium- and Heavy-Duty Vehicles, Medium- and Heavy-Duty Vehicle Parts, and Buses into the United States included a provision to self-declare certain auto and truck parts and components as being subject to the tariffs with certain requirements.

Mercosur Update

Let’s rewind to December 6, 2024. A deal more than 25 years in the making, covering over 700 million people and a combined GDP approaching $22 trillion, became realized. Since then, the agreement has made notable institutional progress while encountering renewed legal and political resistance that will shape its path to implementation. What’s happened recently?

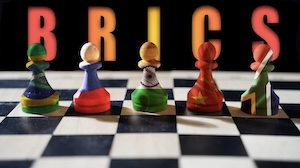

BRICS: An Update and a Challenge

Has BRICS finally produced an alternative to the “petrodollar” after twenty years? And does it live up to the hype? Depending on where you look online, key details are being left out. So, let’s slow down and review what’s actually happening.