Self-Declaring Under the Section 232 Automotive and MHDVP Programs

The October 17, 2025 Presidential Proclamation 10984 Adjusting Imports of Medium- and Heavy-Duty Vehicles, Medium- and Heavy-Duty Vehicle Parts, and Buses into the United States included a provision to self-declare certain auto and truck parts and components as being subject to the tariffs with certain requirements.

Mercosur Update

Let’s rewind to December 6, 2024. A deal more than 25 years in the making, covering over 700 million people and a combined GDP approaching $22 trillion, became realized. Since then, the agreement has made notable institutional progress while encountering renewed legal and political resistance that will shape its path to implementation. What’s happened recently?

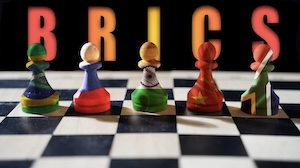

BRICS: An Update and a Challenge

Has BRICS finally produced an alternative to the “petrodollar” after twenty years? And does it live up to the hype? Depending on where you look online, key details are being left out. So, let’s slow down and review what’s actually happening.

After Two Decades of Failing to Come to an Agreement “The Mother of All Deals” is Done – Kudos to India and the EU

As of 1/27/2026, India and the EU have finalized a free trade agreement described by both sides as the “mother of all deals” that slashes tariffs, opens markets, and creates a combined economic region of roughly two billion people. This FTA stands as one of the most consequential global trade realignments in years, driven in part by U.S. tariff pressure and a shift in strategy toward diversifying one’s supply chains.

Hot Topics in International Trade – The Davos Speech by Canadian Prime Minister Mark Carney The Middle Powers Playbook and a Global Trade Realignment in the Making

For whatever reason, if you missed the spectacle created by President Trump on the world stage recently in Davos, Switzerland at the World Economic Forum, you really need to pay close attention now to the fall out. Top business executives in global economies were watching and probably also wondering just who the hell was going to stand-up to the U.S. pressure campaign, and that’s where Canadian Prime Minister Mark Carney stepped up to the mic and delivered a speech that sent shockwaves across continents.

Global Chaos and Global Trade – The New World Disorder and the Ensuing Economic Carnage

On any given morning so far in 2026, looking around the globe, one could easily surmise that chaos rules, and the world of trade as result is on fire. The global landscape is filled with trade barriers, tariffs, sanctions, and export controls, from microchips and dairy to lumber, steel and aluminum. We have seen where geopolitical disputes often escalate into trade wars, where countries impose tariffs or targeted restrictions on each other’s goods, but an actual invasion, that’s on a totally different level regarding how it affects trade and global economies.

The Upcoming USMCA/CUSMA/T-MEC Review The Options are: A Renegotiation, A Few Revisions, or a Formal Exit

The exit of a country, such as the U.S., from the USMCA, well, that’s just crazy, right? Afterall, it’s a powerhouse of a trade agreement between the three nations. According to the U.S. International Trade Administration, the United States conducts over $1.3 trillion in annual trade with Mexico and Canada under the USMCA framework and supports roughly 17 million jobs across North America.

Potential IEEPA Refunds Guidance

The legality of the Fentanyl IEEPA tariffs and the Reciprocal IEEPA tariffs is currently pending in the Supreme Court. A decision is expected in January, although it could come sooner, though the Court may not directly address refund mechanics. Instead, it could remand the issue to the Court of International Trade (CIT), which would delay guidance for several months.

BRICS and the Drive Towards De-Dollarization: Has It Stalled?

Could BRICS break the dollar’s grip? The answer is coming into sharper focus, and it’s more complicated than either the optimists or skeptics predicted. Since our previous analysis, BRICS has made concrete moves toward de-dollarization while simultaneously confronting harsh economic and political realities. The gap between ambition and achievement has never been clearer.

Taxing Imports: Tracing the Role of Tariffs in U.S. Economic Policy

In the Chinese zodiac calendar, 2025 is the year of the snake. The snake is said to represent wisdom and strategy. As it occasionally sheds its skin, it is also said to represent a change or an inflection point. Whether American trade policy in the year of the snake exemplifies wisdom and strategy depends on one’s political perspective. Whether it exemplifies a major transformation and inflection point is unquestionable.